Sydney first-home buyers sacrificing car spaces to get on the property ladder

Is a car space a necessary feature to have with a property? Some Sydney first-home buyers are forgoing them, just to be able to afford to something

Desperate first-home buyers are driving a surge in demand for apartments without car spaces, saving between $70,000 and $100,000 on the price of a unit to help them get a foot in the property market.

Developers report that Australia’s longstanding love affair with the car seems finally to be stalling as the percentage of apartments built with car spaces falls steadily in response to the trend.

“I started looking for something to buy a year or two ago, and wanted something nice but not too expensive,” said William Boulis, 25, a Sydney technology management consultant. “I tend to use public transport to get to where I need to go, to work or to the gym.

“So I decided the money I’d save by buying an apartment without a car space could buy me a bigger apartment – a one-bedroom with a study – and enable me to buy higher up too. It was a no-brainer, it really was. There’s such easy access to public transport here, I didn’t have any hesitation in buying an apartment without a car space.”

Mr Boulis, who currently lives in Ryde, has just bought his first home off the plan in Midtown MacPark, a new master-planned, 3300-apartment neighbourhood being built by Frasers Property Australia in Macquarie Park. He paid $685,000 for a unit on the eighth floor of the first building of 274 units.

Frasers general manager development NSW Nigel Edgar said Mr Boulis was one of a number of first-home buyers now chasing the 90 apartments without car spaces out of every 1000 units built at the project – a car parking ratio of 9 per cent – 500 metres from the station and 500 metres to the shopping centre.

“We’re finding apartments without car spaces are particularly popular in developments that are well located near transport and, as apartments have become more expensive, first home buyers are getting keener on them,” Mr Edgar said.

“They want to fit below the first-home-buyer grant threshold of $800,000 so if you can keep the price of an apartment down in an area where you can walk to a train or have access to a car share, they think it’s worth it, especially when young people think a car will cost them $5000 a year before it’s even driven out of the garage. They’re coming to the conclusion that amount of money is better used paying off a mortgage.”

That car parking ratio of 0.9 per cent has fallen steadily in developments over the past 20 years, and has dropped as low as 0.5 per cent in some developments on top of transport hubs closer to the city.

Keeping the price down can be a top priority for first-home buyers who, if they purchase a home for $750,000 or less, receive the First Home Owners Grant (New Homes) of $10,000. In addition, if it’s $800,000 or below, stamp duty is waived.

Many first-home buyers, spooked by recent news stories about defects in new buildings, are also preferring to spend the money they’re saving on car spaces on buying apartments in projects they perceive as being good quality, says Colliers director of residential Blake Schulze.

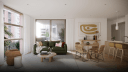

“There’s definitely been a shift in buyers’ mindsets,” he said. “They’re saving $70,000 to $100,000 without the car space, which is a lot of money for a first-home buyer, but it means they can still afford a brand new apartment close to public transport and with amenities, like in a project like Alex_Collective in Alexandria.

“It’s something we’re now seeing more and more, with so much new infrastructure going in, like the new metro and light rail. And car spaces, particularly as you get closer to the city, are becoming more and more expensive, with some councils paring back car park allocations. Some are now almost the price of a studio or one-bedroom apartment themselves!”

A car space in Potts Point, for instance, last month sold for $225,000, while a few years ago, a space in an apartment complex in the CBD, on the corner of Bond and George streets sold for $330,000, and later listed in 2018 at $475,000.

But with the improvements in public transport and the advent of car-sharing companies like GoGet and taxi companies like Uber, car spaces are losing their gloss, says David Milton, the managing director, residential projects Australia of CBRE.

“What’s happened with Uber has changed the world,” he said. “So many people use it now that lots don’t even have a car. Public transport is also there for everyone and it’s so easy. There’s definitely a swing to other modes of transport and away from car spaces for first-home buyers.”

View full article here