Apartment prices set to bounce as houses become too expensive

Apartment price growth is starting to catch up with that of houses after lagging since the onset of the pandemic

Apartment price growth is starting to catch up with that of houses after lagging since the onset of the pandemic, as affordability deteriorates and investors return to the unit market in greater numbers. Throughout the first quarter of the year, capital city house prices were rising about1.1 percentage points faster than units each month. But by August, the gap had shrunk, on average, to 0.7 percentage points, analysis by CoreLogic shows.

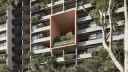

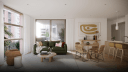

Strong demand from first-home buyers and investors helped sell more than 90 per cent of the apartments at Midtown MacPark, in Macquarie Park, in Sydney’s north.

The narrowing divide is most apparent in Sydney, where houses are fetching, on average, 1.6 times more than units. Since March, when the price growth differential was the widest ever recorded at 2.2 percentage points, the gap has steadily narrowed and was just 0.6 percentage points during August.

“The performance gap between houses and units is diminishing, mostly because houses are becoming substantially less affordable than higher density options,” said CoreLogic research director Tim Lawless.

“Sydney households were spending 11.3 times their gross annual household income to buy a house, compared with 7.7 times for units.

"Mr Lawless said the growing investor activity would help narrow the gap further.

"Investors are the fastest-growing segment of the market at the moment, and demand from investors is often skewed towards the unit sector,” he said.

"Longer term, as international arrivals are allowed back into Australia, this should have a positive flow-on effect to rental demand, especially across the inner-city unit sectors of Melbourne and Sydney, which in turn should attract more investment attention to this sector.”

Capio Property Group chief executive Mark Bainey said the growing confidence in the Sydney apartment sector would also bolster stronger price growth in the months ahead.

“Buyer confidence is definitely being restored to the apartment sector with the appointment of the [NSW] Building Commissioner, David Chandler,” he said.

“Smart developers are realising that they need to provide a much higher level of structural integrity to their development, and this goes a long way in restoring confidence, which was diminished by the Opal Tower debacle and the like.

“We’re seeing such strong demand for apartments … so we’re looking to bring forward the launch of one of our high-rise developments to early 2022, in time for the reopening of the international border.”

Nigel Edgar, NSW general manager of development for Frasers Property, said strong demand from first-home buyers and investors helped sell more than 90 percent of the group’s Midtown MacPark development in Macquarie Park, Sydney, since launching in October last year.

“We’re getting close to 50 per cent of investor buyers, which is typical of what we've seen over the past 20 years,” he said. "First-time buyers accounted for about 42 per cent of our buyers, which has been the strongest we’ve seen for many years.”

Full article written by Nila Sweeney of the Australian Financial Review on September 08, 2021