On the rebound

Last year was a tough one for property investors with international migration halted, the economy in freefall, and general uncertainty. It was a perfect storm of bad news. But in 2021, there are signs that the weather is improving as investor confidence rebounds.

Investor activity shrank markedly in 2020 off the back of a sharp economic contraction flowing from COVID-19 impacts. With government stimulus flowing freely for owner-occupiers and first home buyers, property investors found themselves taking a back seat for the first time in a long time.

After cratering in mid-2020, loan approvals to property investors have been steadily increasing month on month, indicating that investors are quietly returning to the market. With ultra-low interest rates on offer and the worst of the pandemic seemingly now behind us, Frasers Property's General Manager of Sales Programs, Kesree Jones, says that savvy investors are getting back in before the market takes off again. "Back in May last year, the sort of hard-stop in the economy due to COVID-19 had a lot of investors really shaken", says Kesree. "International students went home, and this was felt heavily throughout the rental market, especially in locations close to universities. But late last year and early into 2021 we've seen confidence start to creep back as investors take advantage of the lull. When you have the head of the Commonwealth Bank come out recently and say that they expect to see an eight per cent rise in house prices this year, that's very motivating to move quickly."

With credit at its cheapest in sixty years, the price and availability of financing has been a big factor in improved investor confidence. The other has been the relative stability of property compared with the recent volatility of the stock market.

"The current low interest rate environment and access to credit is continuing to make property ownership and investment very attractive,” says Frasers Property Executive General Manager Development, Cameron Leggatt. “And though I think we may experience some drop in volumes after JobKeeper ends, we’ll see demand for quality stock continue throughout the year because, on average, property remains a stable asset with long-term appreciation trend.”

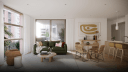

One of the unforeseen circumstances of last year’s lockdowns and travel restrictions was the increase in savings for many Australians. Figures revealed by the Federal Treasury earlier in the year showed that household savings grew by more than $100 billion in the 12 months to the end of November 2020. Driven by an inability to go on holiday, concerns over job security, an increase in ‘rainy day’ savings, and an almost complete stop in spending on restaurant visits, theatres, and sporting events, the unplanned savings boost has flowed on to the property market. “When you can’t get a reasonable return on your cash in the bank that’s when investors look to property, and this is why we are now seeing increased activity,” says Kesree. “We have a lot of seasoned investors through our Frasers Property loyalty program, but what’s been interesting to observe is the number of first-time investors coming to us with a desire to get their savings working for them either through rental yields or capital appreciation, or a combination of both. At projects like Burwood Brickworks in Melbourne, Midtown MacPark in Sydney, and Minnippi Quarter in Brisbane, investors are snapping up opportunities where quality rentals are in short supply.”

Choosing the right investment property

Kesree Jones has been in the property business for 25 years. She says there are five key things to consider when investing in property:

1. Study up

Don't let your heart get in the way of your head. do your research: get to know the area, talk to the locals, browse recent property sales and listings, spend some time at the local shops. You'll get a good idea of the character of a neighbourhood by spending some time there and simply observing.

2. Keep your eye on the P.I.E

Pay attention to the property fundamentals: Population; Infrastructure; Employment. Is the area on the up, with population and prices growing? Are there valued infrastructure projects planned or underway? Are there jobs available that make moving into the area attractive for renters?

3. Know your position

It’s critical to know your equity position, especially if it’s in an existing home. Contact a valuer or your bank to find out how to get an accurate view, so you know how much you can borrow against.

4. Think like a renter

You personally don’t need to imagine yourself living in the rental property you buy, but it sure helps if you imagine what a tenant would want. Chances are it’s the same stuff you’d need: a nice neighbourhood, amenities and services, good transport — and for young families, schools and childcare close by.

5. It's easier to be green

The times, they have a-changed, with renters favouring properties that allow them to live with a light environmental footprint: public transport, energy and water efficient appliances, solar power, bike storage, electric car-charging stations, and neighbourhood walkability all make a location more desirable.

See more articles on